A Guide to Utilizing Blocksquare Token Rewards through Oceanpoint Liquidity Staking

Are you a member of the Blocksquare community or interested in crypto transactions? Whether you’re experienced or just starting, this guide will teach you how to utilize your Blocksquare token rewards. In this article, we will explain how to purchase Blocksquare tokens (BST) and stake your liquidity to earn rewards.

Before we get started, it’s essential to purchase Ethereum (ETH) to facilitate transactions on the blockchain. You can purchase ETH on international or local exchanges and store it in your MetaMask wallet.

Once you have ETH in your MetaMask wallet, you can purchase other tokens through decentralized exchanges (DEXs). For today’s tutorial, we’ll be using Web3 technology to purchase BST and deposit it into Uniswap, a popular DeFi protocol that enables the creation of liquidity pools for specific tokens. Are you ready to learn how to stake your liquidity and earn rewards on Oceanpoint.fi? Let's get started with the basic functionalities of Oceanpoint liquidity staking!

When liquidity is provided, it is non-binding and can be withdrawn at any time. The reason someone would provide liquidity is that they earn a fee on each transaction based on the pool share they have. Providing liquidity earns you tokens representing your share in that pool. You can lock these LP tokens in another smart contract to earn additional BST on Oceanpoint.fi, as an incentive for providing long-term liquidity. This concept is similar to a term deposit in a bank where you allocate a portion of your money to be locked for a certain amount of time for a certain interest rate. This rewarding mechanism has a fixed supply of 100 million BST and is available for a limited time, until 40 million BST have been distributed. Blocksquare / Oceanpoint need to create an economic engine that can reward participants beyond that point, and our plan is to do that with the real estate assets that we tokenize.

By adding liquidity, users can increase the supply of both assets (ETH:BST), flattening out the curve and allowing for larger purchases without distorting the price. When larger transactions are conducted, the impact on pricing is smaller.

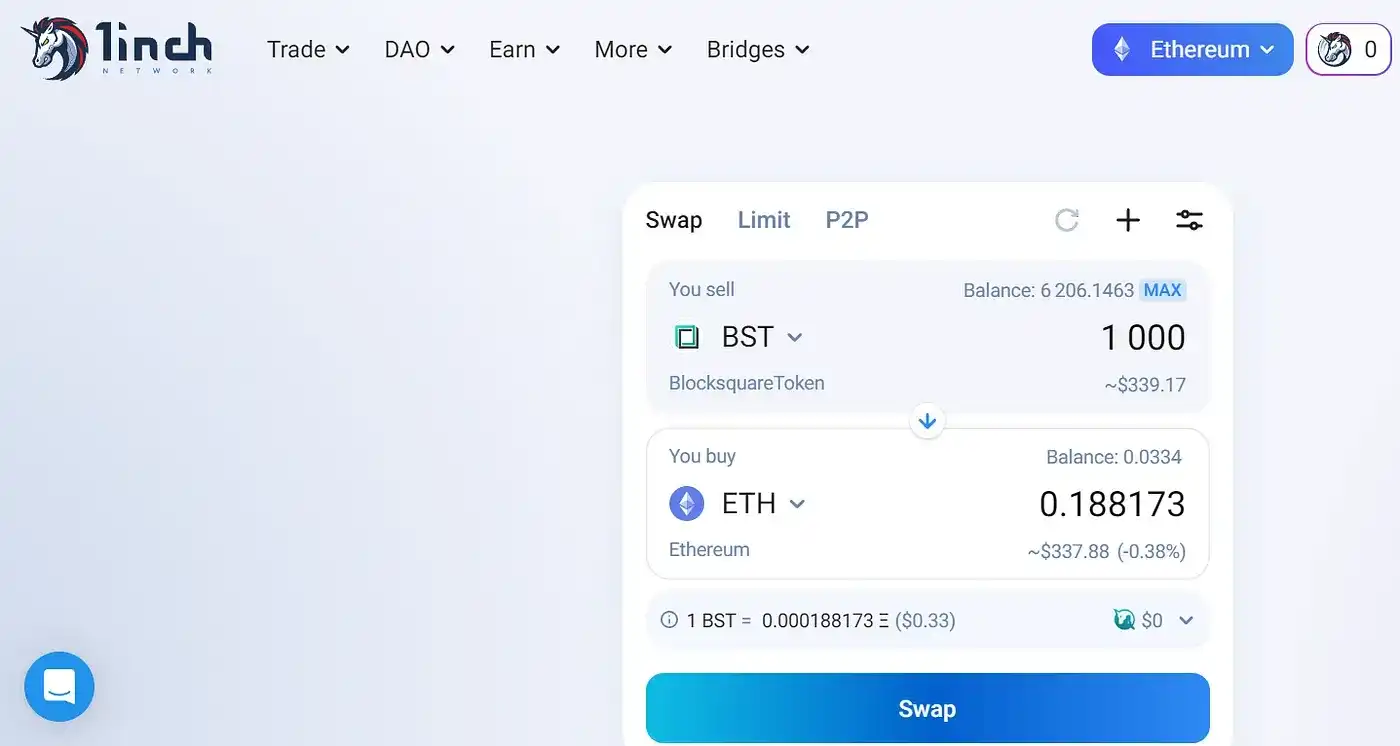

Now, let’s explore how to provide liquidity to Uniswap and purchase BST using 1Inch. 1Inch has a simple user interface that allows you to select the tokens you want to sell and buy. You can connect your wallet using MetaMask or wallets supported by Wallet Connect, select the token you want to purchase, and see the current rate based on the current pricing.

- Check the deposit ratio on the Oceanpoint app to determine how much BST you need to purchase.

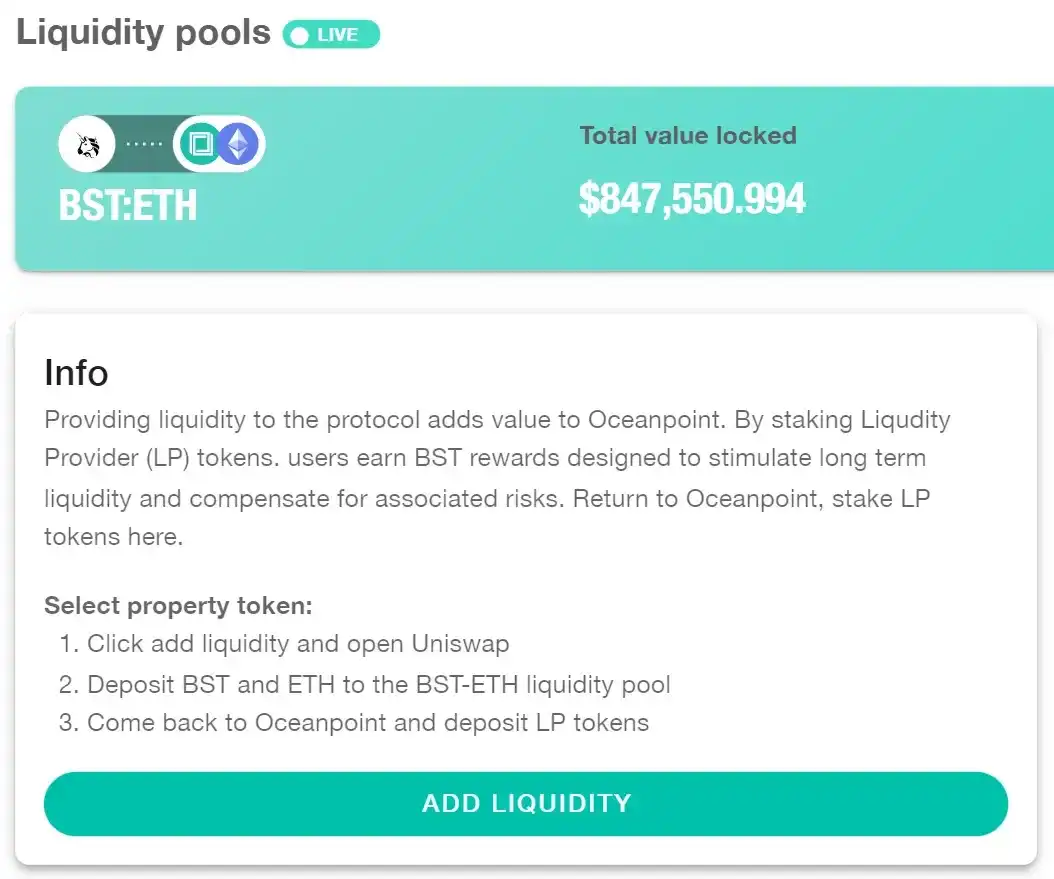

Before acquiring BST, it is crucial to check the deposit ratio to determine how much BST you need to purchase, as you will be providing some ETH and BST in liquidity to Uniswap. To check the deposit ratio, go to the Oceanpoint app and scroll down to Liquidity Pool. Click on 🎭➡️Add Liquidity to open a new tab, which will fill in the other part of the equation based on what you type in. For instance, if you type in 0.5 ETH, the tab will show you the amount of BST you need to provide. If you have 1 ETH in your wallet, you can leave some for transactions and provide 0.4 ETH and the equivalent amount of BST. Once you have the amount of BST you need, go back to 1Inch, enter the amount you want to receive, and 🎭➡️click Swap.

-

Wrap your ETH to Wrapped Ether (wETH) to satisfy smart contract standards. Before you can swap, you need to wrap your ETH to Wrapped Ether (wETH) because many smart contracts require a certain standard. To do this, you need to send your ETH into a contract and get wETH, which is one-to-one with ETH.

-

Give permission to the smart contract to execute transactions with wETH.

-

Confirm the swap on 1Inch.

While it may take some time to complete the transaction due to network congestion (up to 3 minutes), the benefits of providing liquidity to Uniswap are worth the effort.

-

Go to app.oceanpoint.fi and connect your wallet.

-

Open liquidity pool.

Click on 🎭➡️Add Liquidity and follow the steps on Uniswap to finalise your equal submission of ETH:BST. In exchange, you will now receive LP tokens.

- Deposit LP tokens to Liquidity pool on Oceanpoint and choose booster (up to 4x)

When people remove liquidity from Oceanpoint, the share of tokens you hold increases, but the number of tokens in your wallet remains the same. You can view transactions, ads, and liquidity on the platform, as well as see the distribution of accounts on the holder’s list. Some accounts, such as those registered on Etherscan, may have a custom tag. The largest holder of liquidity locked is the Oceanpoint contract, with 83% of all liquidity held.

By clicking on the token holders chart, you can see the distribution of liquidity locked in for different periods, ranging from no lock to a year. By choosing to lock in for a longer period, the value of your rewards multiplies. If you’re risk-averse, you can choose a shorter lock-in period for more flexibility.

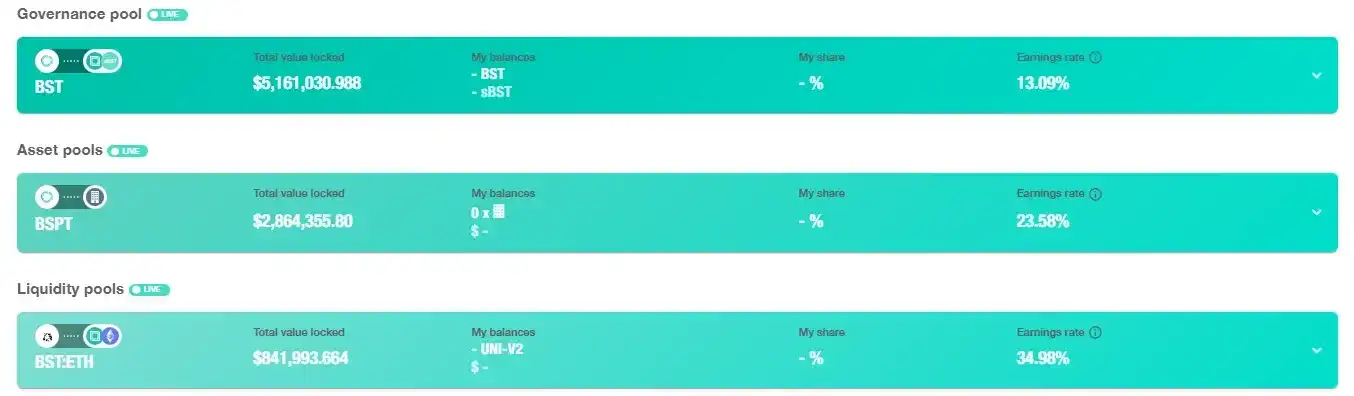

The view of Oceanpoint on the dapp shows that it earns up to 35% APY today. To connect your wallet, you can choose between three types of wallets, but note that having both MetaMask and Trust Wallet installed on your browser can cause conflicts. Once you’ve connected your wallet, you can see the Ethereum you have, but not any Blocksquare tokens (BST). To deposit them, you need to go to liquidity pool and approve the smart contract, just like you did with UniSwap and 1Inch before.

If you want to stake liquidity for a property, you first need to tokenize it and stake the property tokens. Then, you can stake the tokens to get rewards and use those rewards to stake liquidity for even more rewards. You can deposit multiple ways, but you need two wallets or accounts to do so from one account. The smart contract exchanges security for functionality, meaning you can only hold one type of position in one wallet.

Example for liquidity staking booster: For this demo, let’s deposit 100% of the liquidity and lock it in for a longer period of time, say, four times (1 year). Although you can choose to deposit different amounts for different periods, we’ll stick to depositing everything at once. By doing so, you can estimate your pool share on the right side of the platform. For a one-month lock-in period, there’s a 1.6x increase in rewards, while for three months, it’s a 2x increase.

Understanding the Power of Web 3.0 and Decentralized Finance: Insights from the Block-Chat Podcast The recent Block-Chat [#50] shed light on the importance of learning about smart contracts and how they are a vital component of the blockchain ecosystem. While many people have purchased cryptocurrencies on centralized exchanges, they may not have fully understood the underlying protocols of the technology.

Our COO Makram Hani and CEO Denis Petrovcic took the time to explain these concepts in a user-friendly manner, providing step-by-step instructions on how to use the Blockquare ecosystem applications like Oceanpoint. They acknowledged that while it may take some initial effort to learn, the processes are quite simple once you get the hang of it.

For those new to the topic, the Block-Chat is an excellent resource to increase knowledge about real-world asset tokenization and get to know something new. The show also provides insights to those already familiar with the technology, helping them stay up-to-date and learn new things.

As a member of this community, we thank you for your support and look forward to the next episode.