Blocksquare’s Visit to Ljubljana: Enhancing Transparency and Mitigating Risks through Asset Onboarding

The journey of asset onboarding, the role of AI-driven lease agreement screening, and the transformative power of blockchain technology in real estate.

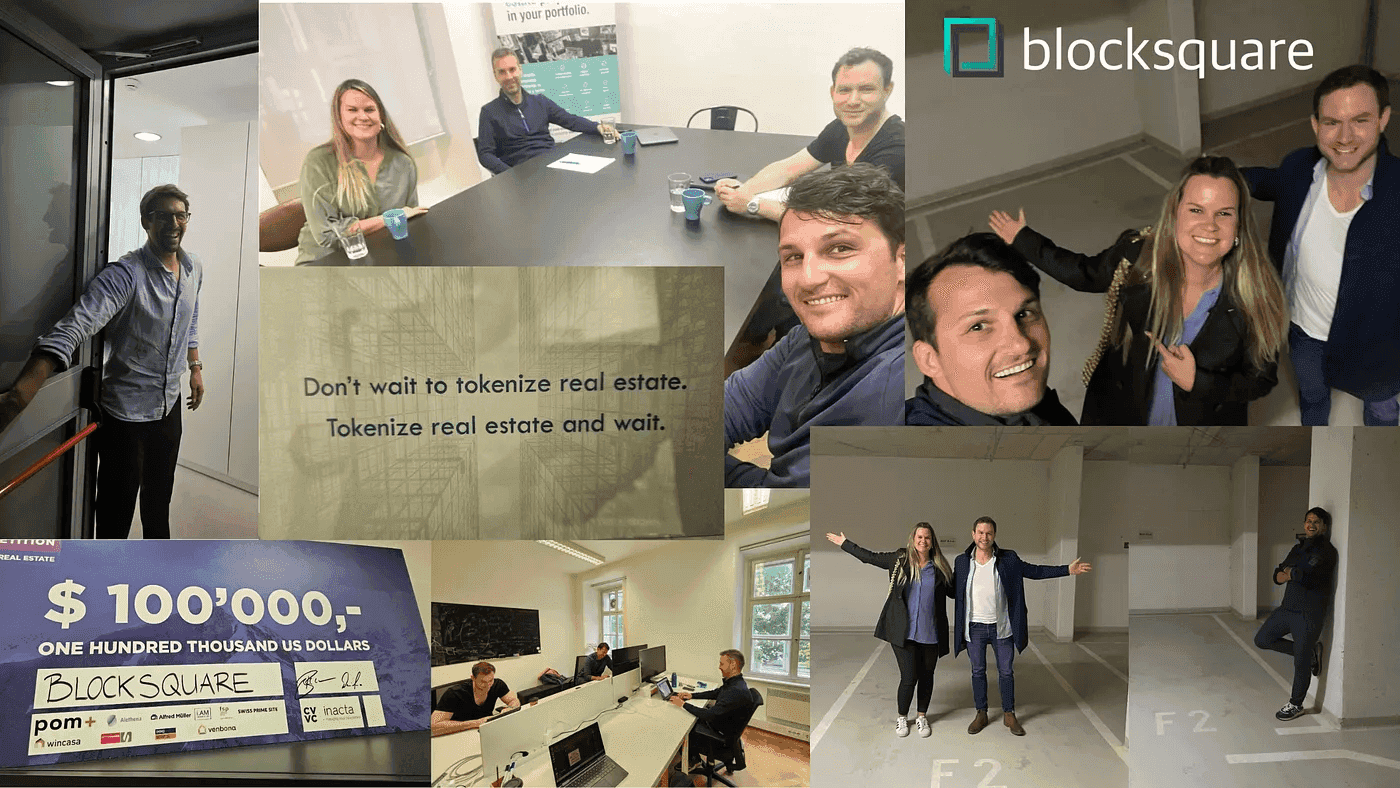

Last week, something exciting happened at Blocksquare! Our Head of Risk, Daniel Kaines, and CMO, Julia Buchholz, visited our Blocksquare HQ in beautiful Ljubljana, Slovenia. It was a remarkable opportunity for them to collaborate with the rest of the team in person. They had productive discussions about recent developments, asset onboarding for Oceanpoint, and shared their valuable experiences. This blog explores the journey of asset onboarding, the role of AI-driven lease agreement screening, and the transformative power of blockchain technology in real estate.

During their visit, the team discussed recent developments, particularly the assets that have been onboarded for Oceanpoint and the new real estate owners who have joined through this process. With Daniel Kaines playing a crucial role in overseeing the asset onboarding process, weekly meetings involving Makram Hani, Denis Petrovcic, and Julia Buchholz are held to review and evaluate incoming assets meticulously.

Streamlining Asset Onboarding and Mitigating Risk

One of the key discussion topics was Daniel’s role in overseeing asset onboarding. He gave us insights into the entire process, from the initial consultation with asset owners to verifying ownership documentation, property location, associated debt facilities, and even considering high-quality images and the annual percentage yield (APY). We also got a sneak peek into an ongoing project that involves leveraging AI language models to review lease agreements. This exciting initiative aims to enhance transparency and reduce risks for potential buyers. We are actively developing this language model and plan to incorporate it into our onboarding procedures to ensure even higher compliance and risk assessment standards.

Decoding Revenue and Annual Percentage Yield (APY) in Real Estate

Understanding revenue and APY in the real estate world is crucial, and it involves considering various sources of income, like rental income or proceeds from property sales. Corporate resolutions outline the obligation for asset owners to allocate a percentage of net revenues to token holders annually. Interestingly, businesses that occupy their real estate may have a lower percentage allocated for rent, but they enjoy advantages in terms of control and management capabilities.

Factors Influencing APY and Token Valuations

Marketplace dynamics play a significant role in determining the APY, as it tends to decrease when the token price increases. The buying position of investors becomes crucial, and each investor’s APY may vary based on their entry point. Asset owners can adjust their initial sale valuation to make the APY more competitive and attractive to potential buyers. It’s worth noting that asset valuations and token valuations can differ. Property valuation serves as one metric, while token valuation is another. Tokenization allows property owners to generate additional income through cryptocurrency and embrace the benefits of blockchain technology.

Bridging the Knowledge Gap: Education and Awareness

Education and awareness initiatives have played a vital role in bridging the knowledge gap and building confidence in blockchain applications for real estate. By tokenizing their property, owners gain exposure to the crypto economy and earn cryptocurrency as an additional income stream. This unlocks new possibilities and value in the digital asset realm. However, it’s important to acknowledge that the initial property valuation during tokenization may not always align with its real-world valuation. Asset owners have the flexibility to set their listing price, and potential buyers can decide whether to purchase at that price.

Oceanpoint’s Hybrid Model: Embracing the Future of Real Estate Tokenization

Oceanpoint offers a hybrid model that allows investors to earn revenues through the traditional APY model and stake a portion of their tokens in the community pool to earn BST, the native token of Oceanpoint. This approach provides flexibility and the potential for higher returns. The goal of tokenizing real estate is to make it attractive for DeFi purposes and enhance the value of real estate assets in the DeFi space through access and liquidity extraction.

Recently, we’ve made significant progress in real estate tokenization. We’ve successfully tokenized $8 million worth of real estate, with eight properties valued at $5 million tokenized in one week and seven valued at $3 million tokenized in the following week. This showcases the growing success and adoption of real estate tokenization.

Tokenization offers several advantages for property owners. They can earn staking rewards, which serve as an additional source of income and can help offset increased interest rates on mortgages, for example. However, we also understand that there are challenges in approaching property owners about tokenization, as many are unfamiliar with the concept and may have never interacted with a crypto wallet before. That’s why education and awareness initiatives are crucial to bridge this knowledge gap and build trust.