Polytrade and Blocksquare: Powering the Future of Tokenized Assets

In the evolving landscape of blockchain technology, few partnerships hold as much promise as the recent collaboration between Polytrade and Blocksquare, an innovative move that merges the potential of tokenized real-world assets (RWAs) with the robust marketplace structure.

This partnership signals a new era for decentralized finance (DeFi) and real estate tokenization, providing users with novel opportunities to leverage blockchain for traditional asset investment. Through this union, investors, operators, and everyday users can benefit from greater transparency, liquidity, and accessibility. But what does this really mean, and why should you care?

Polytrade Partnership: Expanding Horizons

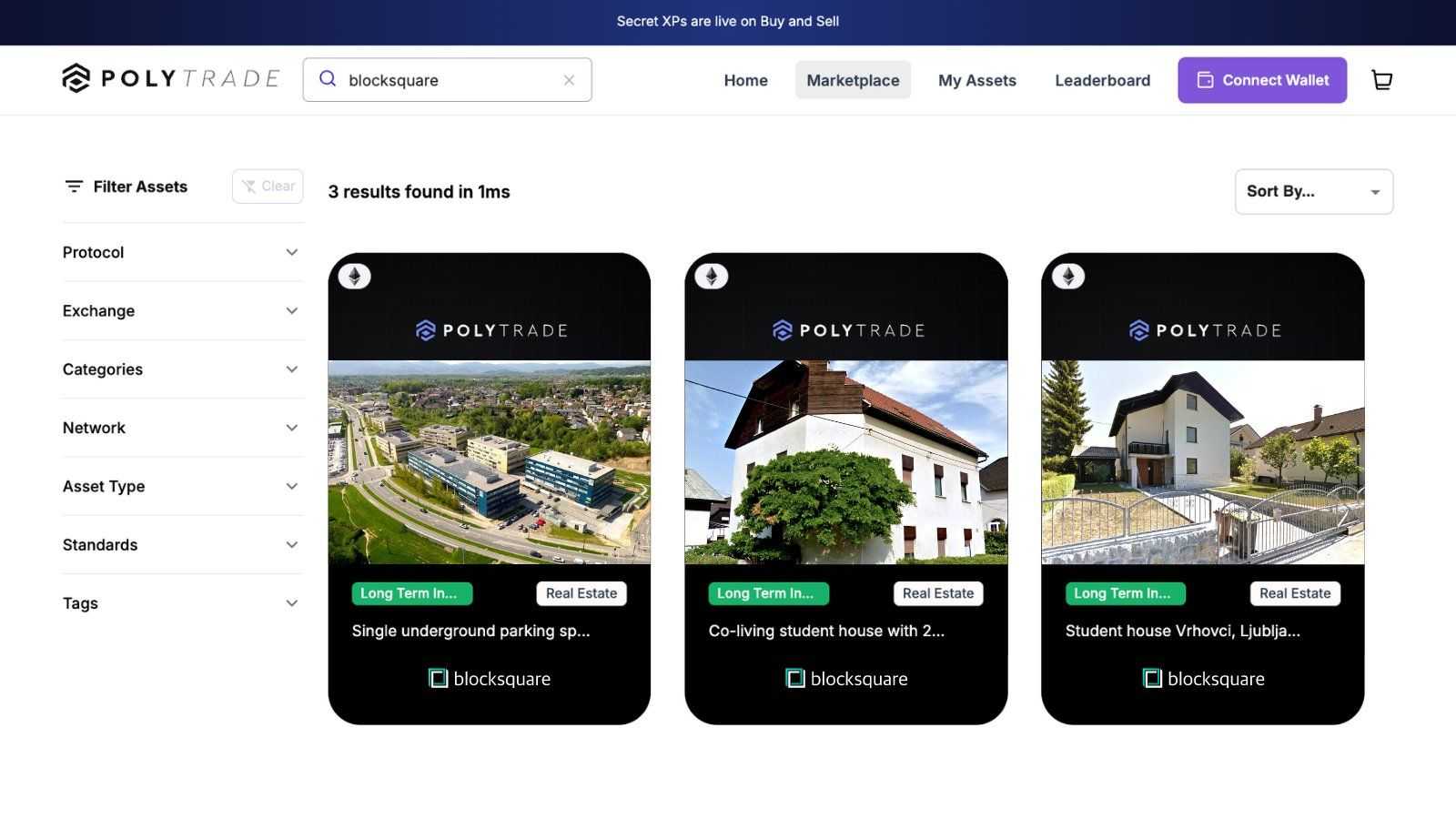

Polytrade has long been known as a marketplace listing a wide range of tokenized real-world assets. From tokenized gold to tokenized art, Polytrade offers a variety of DeFi opportunities that appeal to diverse investor preferences. The latest collaboration with Blocksquare, a leading force in real estate tokenization with over 140 properties on-chain, valued at more than $129 million in 24 countries, benefits both partners and raises greater awareness of real estate tokenization.

With this partnership, the marketplace operators at Blocksquare are able to expose their tokenized assets to a larger audience through Polytrade’s extensive DeFi network. In essence, this integration means that marketplace operators can showcase their real estate tokens on a much broader platform, drawing more attention, investors, and ultimately liquidity to their offerings. It’s a game-changing approach, where both partners stand to benefit from increased exposure and activity within the ecosystem.

For Blocksquare, this is about more than just increasing visibility. It’s about creating a seamless bridge between real estate and DeFi by making properties tokenized and easily tradable through blockchain technology. As new property owners join their DAO (Decentralized Autonomous Organization) on a weekly basis, the demand for real estate tokenization only continues to grow. And Polytrade’s vast audience ensures these marketplace operators will be discovered by a broader range of potential investors.

Driving Growth Amidst Global Economic Shifts

This partnership arrives at an opportune moment as the global economy faces complex challenges. Interest rates are fluctuating, asset prices are volatile, and markets are preparing for an extended economic cycle. With central banks around the world adopting quantitative easing policies, inflationary pressures loom, impacting everything from commodities to real estate. Tokenized real estate, however, offers a stable hedge against these macroeconomic shifts, allowing investors to diversify their portfolios without requiring a huge capital outlay.

Real estate tokenization is gaining momentum not only due to its affordability and accessibility but also because of the increasing involvement of institutional investors. These institutions are turning to RWAs like tokenized real estate to mitigate risks while enhancing returns. As this trend grows, partnerships like that between Polytrade and Blocksquare will become vital in supporting the infrastructure needed for tokenized real estate to flourish on a global scale.

How the Partnership Boosts Real Estate Tokenization

The key to the Polytrade and Blocksquare collaboration lies in community engagement and decentralized participation. Blocksquare already works with 12 marketplace operators, each contributing to the growth of their tokenized real estate ecosystem. These operators tokenize and list their properties, and through this new partnership with Polytrade, they can reach more users, encouraging participation and investment.

Polytrade, in return, benefits from Blocksquare’s ever-expanding list of tokenized assets, which helps them drive traffic to their marketplace. The two-way collaboration ensures a continual cycle of supply and demand within the DeFi space, as each side leverages the other’s strengths to enhance market liquidity and user engagement.

Oceanpoint Staking Experiment: A Year in Review

While partnerships and large-scale integrations are impressive, the true power of blockchain lies in its ability to empower individuals. Denis, the CEO of Blocksquare, shared a case study conducted over the past year, and his findings were truly eye-opening.

As explained in Block-chat #94, a user that collateralized his Ethereum (ETH) on Aave, a decentralized lending platform, and borrowed $1,000 worth of Dai stablecoins. With that, he invested in real estate tokens on Oceanpoint, a platform within the Blocksquare ecosystem. These tokens represented ownership in a property, and the investor staked them for additional rewards in $BST on the platform.

Fast forward to today, and the results of this experiment speak volumes. Despite the turbulent markets of the past year, the investor saw positive returns, confirming that tokenized real estate, when combined with decentralized finance tools, can yield impressive results. What makes this more significant is that even in today’s uncertain market, the rewards from staking property tokens remain consistent.

This experiment highlights how decentralized finance can work in conjunction with tokenized real estate to generate passive income, offering a glimpse into the future of investment.

The Deflationary Impact of the Buyback Process

As part of Blocksquare’s broader ecosystem, the buyback process on Oceanpoint further underscores the value of tokenized real estate. Through this mechanism, stablecoins generated from property returns are used to buy back and burn BST tokens (Blocksquare’s native token), reducing the overall supply and creating deflationary pressure.

The deflationary impact of this buyback process is significant, especially as more properties are tokenized and listed on Blocksquare’s marketplaces. By reducing the supply of BST tokens, the value of the remaining tokens increases, benefiting long-term holders. As more marketplace operators join Blocksquare, and the volume of transactions grows, the buyback process will continue to drive demand for BST, making it a more valuable asset within the ecosystem.

Conclusion: A Future Built on Collaboration

The partnership between Polytrade and Blocksquare marks a turning point in the world of decentralized finance and real estate tokenization. By merging their strengths, they are providing a powerful platform for marketplace operators and investors to tap into the growing world of RWAs. As the market continues to evolve, these kinds of collaborations will be crucial in creating a more accessible, transparent, and profitable ecosystem for all.

This is just the beginning. As tokenized real estate gains traction, partnerships like this will pave the way for more widespread adoption, bringing us closer to a future where anyone, anywhere, can invest in real-world assets with the ease and efficiency of blockchain technology.