Real World Asset Tokenization under future EU regulation (MiCA)

Finally clear regulatory framework - tokenization going mainstream?

Wild West vs. legal certainty

It has often been said, quite rightly, that the crypto industry has been like the Wild West. There was no specific regulation for crypto-based business models. The rules consisted of so-called "soft law," various guidelines from the regulators, which were interpreted in their own way and modified as necessary. This chaotic and uncertain environment underscored the urgent need for a clear regulatory framework.

Even if the rules of the game were clear in one country, this provided absolutely no guarantee that a crypto project would not be subject to regulatory proceedings in another country. According to the logic of the so-called "reverse solicitation," which we know from the systemic European securities regulation (MiFID II), if an individual's participation in a crypto project (e.g., the purchase of a crypto asset) occurred solely at the initiative of that individual, without being actively targeted by the crypto project, the law of the country from which the crypto project was operating would apply. Of course, most crypto projects did not operate this way, as they actively marketed their projects online and through other digital channels. The reverse solicitation was thus not applicable, exposing crypto projects to significant risks, including the risk of class action lawsuits, which have gained momentum in the EU as a result of the Volkswagen case.

The belief of many that the lack of clarity of the legal rules meant that there was an opportunity to do business around any regulatory hurdles was mistaken. Serious projects, and this is not just true of the crypto industry, require legal predictability. Now, with the introduction of the Markets in Crypto Assets Regulation ("MiCA"), the European systemic regulation for the crypto industry, we finally have it. This brings a sigh of relief and a sense of reassurance to the industry.

Real World Asset Tokenization – the serious side of crypto business

There are many types of transactions involving crypto assets in different forms. Certainly, those where crypto assets form a bridge between the digital and the real are more complex than those that are exclusively linked to the crypto sphere. The complexity is primarily reflected in ensuring the entire transaction's integrity. Without ensuring security for all participants, especially the weakest ones, which are usually retail investors, the whole project is exposed to too much risk to be sustainable in the long term.

Real World Assets (“RWA”) tokenization is an example of a bridge that involves converting rights attached to an asset into a digital token on a blockchain. With the tokenization process, illiquid or limited liquid assets become more liquid. In that sense, tokenization is only a process of converting the form of an asset into a digital token (i.e., a crypto asset). That also means that tokenization simply adds an extra (liquidity) layer on top of RWAs. The “old school” business with RWAs is mixed with blockchain technology, whose core purpose is the transfer of value in a digital form. A match made in heaven!

However, applying new approaches based on the technology to old types of transactions means that there is an unavoidable mixture of new and old, usually in the way of old rules and new forms of implementation.

RWAs under MiCA

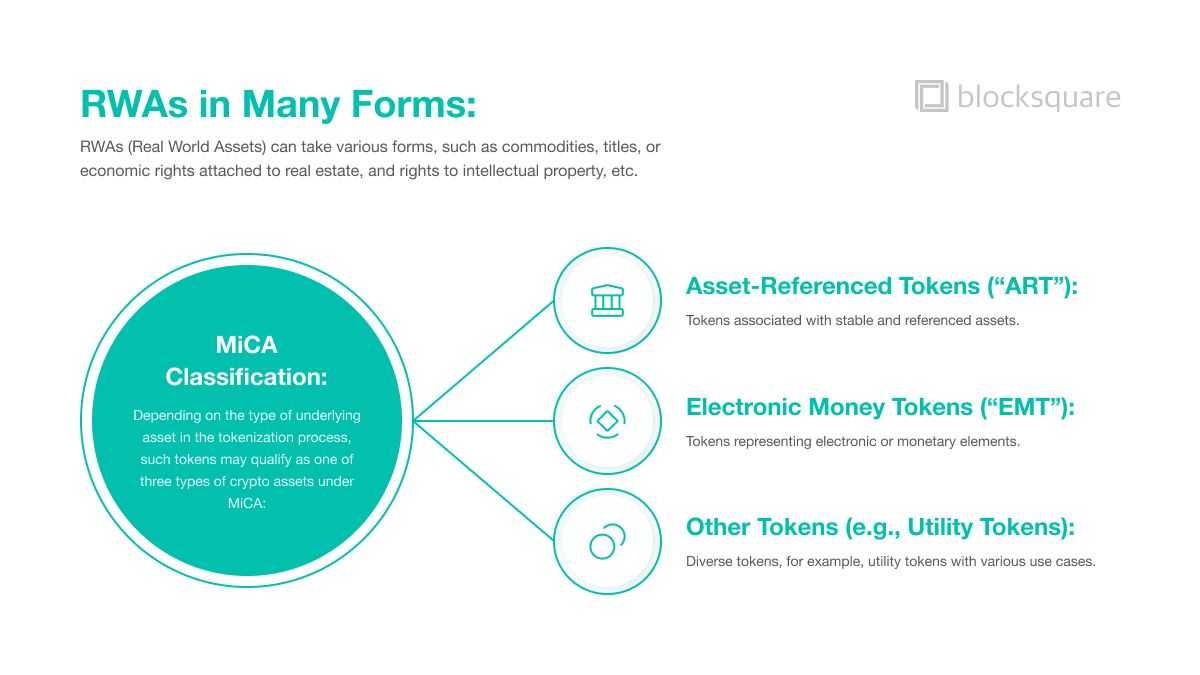

RWAs are in many forms. They may be in the form of commodities, titles, or economic rights attached to the real estate, rights to intellectual property, etc. Depending on the type of underlying asset in the tokenization process, such tokens may qualify as one of three types of crypto assets under MiCA: asset-referenced tokens (“ART”), electronic money tokens (“EMT”). or “other tokens” (e.g., utility tokens).

Asset-referenced tokens (“ART”) have a special place in MiCA. Among others, ARTs refer to a crypto asset that purports to maintain a stable value by referring to the value of one or several commodities. Of the other two categories, EMT is the most regulated category under MiCA, and crypto tokens, which are neither EMT nor ART tokens, are the least regulated category of crypto assets.

For the issuers of ARTs some mandatory rules will apply. These rules refer to publishing a white paper with the mandatory content, obtaining approvals from the competent authority (white paper, marketing materials), providing legal opinion on the legal nature of their token, providing governance structure of the company behind the ART, ensuring competent company’s management (fit&proper) providing other internal and external documents (e.g., risk management, business continuity, complaint handling, program of operations, etc.), ensuring minimal level of capital (EUR 350.000). In addition, very strict rules for the composition and management of the reserve of assets will apply.

For the category of tokens that do not qualify as ART or EMT, a substantially lighter regulatory framework will apply under MiCA. The issuer of such tokens will also need to publish a white paper, and there are some provisions related to marketing communications. There are no special provisions on internal governance, minimal capital, and fit and proper for the management.

Due to the highly regulated nature of ARTs on one side and the very light regulatory approach towards the crypto assets that do not qualify as ART or EMT, it will be much easier for the token issuer to issue the latter.

We believe that practice from the competent national authorities from specific cases and future bylaws (e.g., technical standards, guidelines) to MiCA issued by ESMA and EBA will set clear standards for the tokenization of which RWAs will qualify as a commodity relevant for ARTs and which RWAs will fall out of this definition so that such tokens will qualify as crypto assets other than EMT or ART.

In terms of dates, one more important piece of information regarding MiCA is that the relevant provisions will be in force since December 2024.

How will Blocksquare help?

Blocksquare is not a token issuer. Blocksquare provides a technological infrastructure for RWA (properties) tokenization. In addition, with our broad experiences in the field of property tokenization, we can advise our clients in various fields, including legal and regulatory compliance.

With regard to MiCA, we intend to prepare guidelines for our clients, which will help issue tokens in a MiCA-compliant way, either as ART or as tokens other than ART and EMT. The guidelines will include templates of the key documents, such as white paper, marketing materials and terms of sale.

In this capacity, Blocksquare will not act as a legal consultant. Blocksquare is and remains a tech infrastructure provider. All such support in legal and regulatory compliance matters will be offered on a general level. No tailor-made legal advisory services will be offered to the specific clients.

All such support in legal and regulatory matters will be intended to assist clients in understanding the overall requirements and be offered on a generic and educational basis, with each client/marketplace provider accessing their own legal and regulatory expert opinions relative to their project.