RWA Deep Dive: The Technology Fueling the $60 Trillion Asset Revolution

The Tokenization Tsunami: An In-Depth Analysis of the Infrastructure, Compliance, and Liquidity Rails Driving Real-World Asset (RWA) Adoption (Blocksquare X Space Summary)

The era of Real-World Asset (RWA) tokenization has moved definitively past pilots and hype. This is a structural shift poised to bring trillions of dollars—estimated to be a $60 trillion market by 2030 —onto programmable rails. This article provides a comprehensive deep dive into the technology, compliance frameworks, and market solutions discussed during the RWA Deep Dive: Understanding the Technology Driving Adoption X Space, hosted by Blocksquare and Oceanpoint.

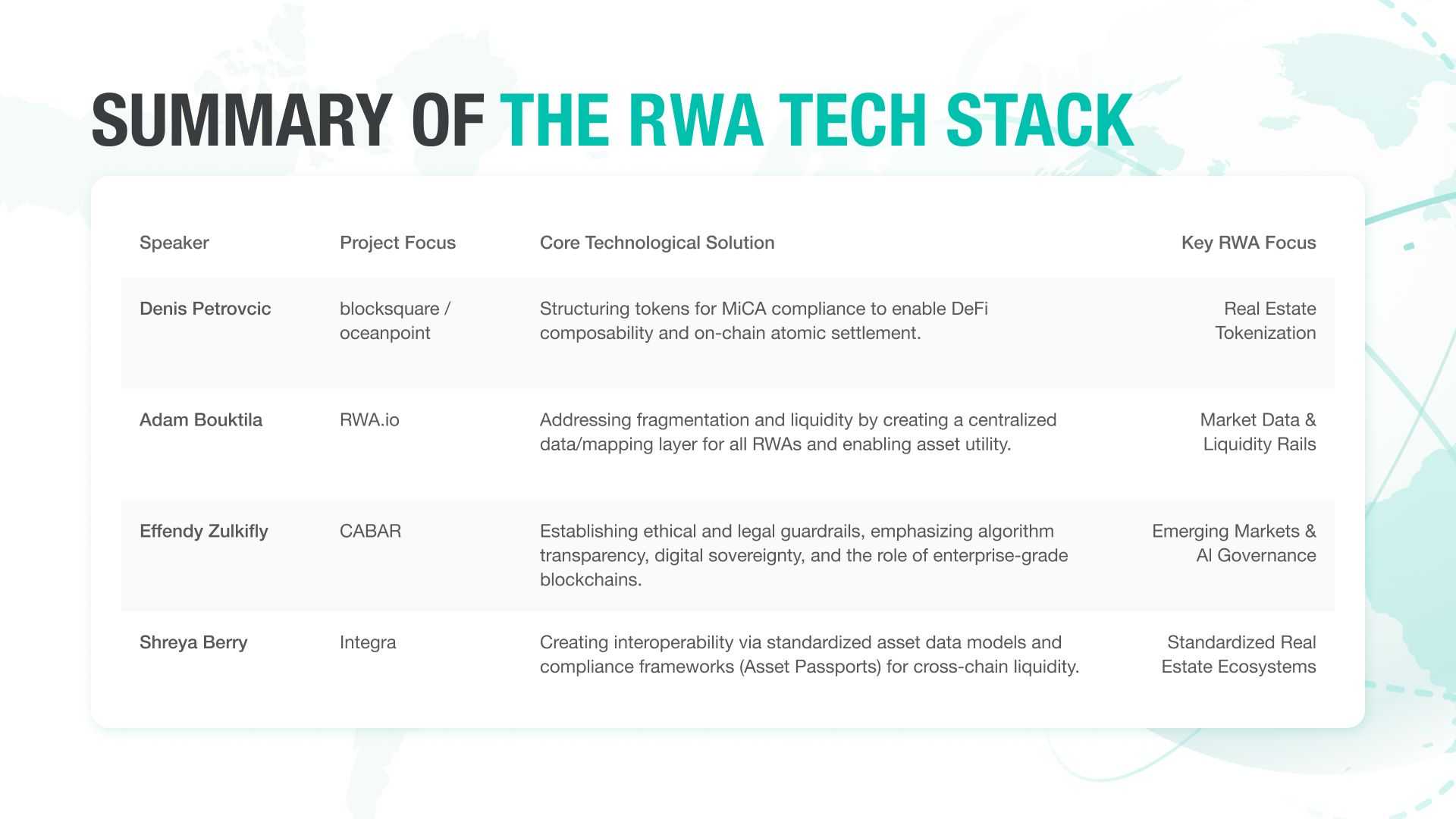

The discussion, featuring key leaders from Blocksquare, Integra, CABAR, and RWA.io, illuminated the critical components necessary for mass institutional and retail adoption.

1. The RWA Inflection Point: Transitioning from Hype to Infrastructure

The conversation established that 2025 is a "massive, massive year" for RWAs. After years of being "in the talk" , the industry is now experiencing a "surge in adoption and infrastructure innovation".

Key Indicators of the Shift:

-

Real Demand: The market is now witnessing "real buy-side demand," which has historically been a major hurdle for RWAs.

-

Massive Market Potential: Projections suggest that over $60 trillion in illiquid assets will be tokenized by 2030, with 10% of global GDP eventually sitting on-chain.

-

Converging Worlds: The core focus of the technological drive is "bridging CeFi and DeFi".

Mark Mariampillai's Key Insight:

"We are really now seeing institutions coming in. We are actually seeing real buy-side demand, which is one of the biggest issues in our RWAs. And today, we're going to focus on that technology layer behind the adoption."

2. The Core Technical Challenge: Atomic Settlement and Regulatory Bridge Building (Blocksquare)

Tokenizing a traditional asset, particularly real estate, presents a significant compliance and technical challenge. It requires ensuring that the digital token truly represents and enforces legal rights while remaining composable within DeFi.

Denis Petrovcic, CEO of Blocksquare, detailed the approach required to bridge traditional CeFi structures—like SPVs and custodians—to DeFi models.

The Blocksquare Framework:

-

Atomic Settlement: The fundamental requirement for a tokenized asset is that when an investor buys a token, the economic rights must "settle directly onto... the new owner" on-chain.

-

Transfer of Economic Rights: Blocksquare focuses on transferring economic rights on-chain. These rights then "settle between... investors when they purchase and sell these tokens on chain".

-

Navigating Securities Law: A critical distinction is made: the goal is to create tokens that might not be regarded as securities in jurisdictions like Europe (under MiFID II) but may be categorized as other crypto assets under MiCA.

-

Enabling DeFi Composability: By structuring the tokens as crypto assets (rather than tokenized securities), they gain the crucial ability to "live in DeFi protocols" and "interact with DeFi protocols". This is key because restrictions on tokenized securities do not apply to these crypto assets.

Denis Petrovcic's Key Insight:

"The interesting part is that these tokens can actually reside within DeFi protocols. Nevertheless, since they are not classified as tokenized securities, the restrictions governing such securities do not apply to them, precluding their interaction with DeFi protocols."

3. The Liquidity Problem: Solving Fragmentation and Building Access (RWA.io)

For mass adoption, RWA tokens must achieve sustainable on-chain liquidity and seamless distribution. Adam Bouktila, CSO of RWA.io, highlighted that the industry is still concentrated on primary issuance, with secondary market trading yet to be fully unlocked.

Obstacles to Liquidity:

-

Fragmentation: Liquidity is "siloed in different chains". This requires "data standards, API standards, and integration standards" to bridge the traditional finance world.

-

The "Good Product" Rule: Tokenization does not magically create demand. A product must be inherently good and "compelling" with attractive yield to justify institutional risk and effort.

-

Long Lockups: Long lockup periods are a major deterrent, requiring creative solutions like enabling the token to be used as collateral in DeFi lending markets to provide utility and liquidity from day one.

The Access Challenge: Adam stressed that the biggest remaining issue is access. The necessary technology and regulation are largely in place, but connecting users and capital is the next step. RWA.io aims to solve the fragmentation issue by mapping hundreds of projects and serving as the "front door" for the next wave of users.

Adam Bouktila's Key Insight:

"The problem here is these institutions can already get access to many different sources of yield... unless the product that you're issuing is actually noteworthy or it stands out, it doesn't mean that it's magically going to sell."

4. Legal Guardrails and Digital Sovereignty in Emerging Markets (CABAR)

The RWA shift carries significant implications for policy, ethics, and governance, especially in emerging regions like Malaysia, Indonesia, and Saudi Arabia, where RWAs can be a "level playing field". Effendy Zulkifly, Founder of CABAR, focused on the critical legal and ethical frameworks required to ensure fairness and inclusion.

Essential Ethical and Legal Guardrails:

-

Algorithm Transparency: Where AI is used for core functions like "asset pricing, risk scoring, or compliance automation," there must be no "black box AI".

-

Sovereignty and Data Localization: Critical national data—such as "land registries, mineral reserves, agricultural yields"—must be "processed and stored under national jurisdiction". Countries must not outsource their sovereignty to external compute or governance.

-

Legal Dual Recognition: New frameworks need to grant dual recognition for tokenized assets across both traditional legal and digital registries.

-

Tiered Identity (KYC/AML): Compliance models must be "suitable for unbanked or thin-file populations".

The Role of Enterprise Blockchain: Effendy sees enterprise blockchain playing a crucial role as the backbone for regulators, providing the necessary audit trails, monitoring, and control required by government agencies.

Effendy Zulkifly's Key Insight:

"For Asian and other emerging regions, RWA tokenization can be a great equalizer, but only if the frameworks protect fairness, accessibility and national autonomy from day one."

5. Interoperability and the Future of the Asset (Integra)

The ultimate vision for RWAs is a global, chain-agnostic market. Shreya Berry, Core Contributor at Integra, highlighted the need for standardization, arguing that "interoperability in Web2 only became real once banks and fintechs adopted standard data models and APIs".

Standardization Pillars for Tokenized Real Estate:

-

Canonical Asset Identity (Asset Passport): A "chain-agnostic asset passport" is needed so that "every property carries a unified verifiable record" of provenance, ownership, and compliance—creating "one source of truth across chains".

-

Machine-Readable Compliance: Rules must be "encoded as standardized modules" that any marketplace can use to instantly check eligibility.

-

Shared Liquidity Rails: By standardizing the asset schema, a global order book can be created to "route bids and trades across ecosystems".

The Future: From Liquid to Intelligent Assets The panelists agreed that the technology is driving the asset toward greater intelligence and autonomy.

-

Convergence on Ethereum: Ethereum is expected to become the "go-to smart contracts platform" for RWAs. Institutions are likely to feel the "safest" there, and the platform has the largest developer community, which is crucial for driving fast innovation and security.

-

The Intelligent Asset: The future asset will not just sit on a ledger but will "update themselves, self report their condition through IoT oracles, get prices by transparent AI models and settle instantly across jurisdictions".

Shreya Berry's Key Insight:

“The result is simple: when assets and compliance are standardized, liquidity becomes chain-agnostic and global. That’s the shift that turns tokenization pilots into a real institutional market.”