The Evolution of Real Estate Tokenization: From Manhattan’s 2018 Experiment to the 2025 Blocksquare Standard

In 2018, a luxury condo development in Manhattan (436 & 442 E 13th St) made headlines as the first-ever skyscraper to be tokenized. Led by celebrity agent Ryan Serhant and developer Ben Shaoul, the project promised to "democratize" the New York skyline.

However, looking back from 2025, that project serves as a case study for the massive technical and legal friction of the early "Security Token" era. Today, Blocksquare has transformed those expensive, bespoke experiments into a streamlined, legally-armored infrastructure that delivers on the promises made seven years ago.

1. The 2018 "Manual" Era: The Manhattan Debt-Equity Waterfall

The 2018 Manhattan project was not a simple "tokenization." It was a complex financial engineering feat known as the "Two-Token Waterfall."

The Technical & Legal Burden

To tokenize just 12 units, the property owners had to assemble a specialized "blockchain team" including Fluidity (technical) and Propellr (legal).

-

The Structure: They created a complex Special Purpose Vehicle (SPV) that split the capital stack into two layers: Debt Tokens (a senior loan portion with fixed returns) and Equity Tokens (subordinated ownership with profit sharing).

-

The Friction: Because this mirrored a traditional private placement, it was restricted to wealthy "Accredited Investors." The team had to manually build the compliance logic for this "debt vs. equity" split from scratch, making it incredibly slow and expensive to set up.

2. The 2025 Blocksquare Shift: From Building Tech to Operating Markets

By 2025, the barrier to entry has vanished. Blocksquare has moved the industry from "building the engine" to "driving the car."

White-Labeling vs. Scratch-Building

Real estate teams today don't need to hire blockchain developers or bridge multiple tech firms.

-

Affordable & Fast: Blocksquare offers a white-label marketplace that allows any real estate operator to launch their own branded platform in weeks.

-

Refocused Human Capital: Instead of managing Solidity developers, a 2025 team focuses on operations, local legal assessments, and building community demand. The technical plumbing is handled by the protocol.

3. Two Layers of Protection: Legal Recourse for Every Asset

One of the key flaws in the 2018 Manhattan story was the "missing link" between the digital token and the physical deed. In 2025, Blocksquare provides standardized, enforceable protection for every single asset on its infrastructure.

Layer 1: The Corporate Resolution (Standard for All)

The foundation of every Blocksquare asset is the Corporate Resolution. This is the primary legal shield that protects investors even without formal notarization.

-

Binding Contract: It is a standardized legal document signed by the property owner that officially transfers economic rights (revenues) to token holders.

-

Blockchain-Secured Evidence: The resolution is stored on IPFS, and its hash is embedded in the smart contract. This creates an irrefutable "paper trail." In a court of law, this document serves as a binding financial obligation—if the issuer defaults, the token holder has a clear, evidence-backed contractual claim.

Layer 2: The Notarized Luxembourg Model (The Ultimate Upgrade)

For assets seeking institutional-grade security, the Luxembourg Framework is the ultimate upgrade.

-

Land Registry Integration: This goes beyond a contract by placing a legal charge or lien directly on the physical property title at the government land registry.

-

On/Off-Chain Protection: It combines the security of a bank mortgage (off-chain) with the speed of blockchain (on-chain). This notarized framework ensures that the property cannot be sold or refinanced without the token holders being legally addressed first.

4. The Strategic Advantage: Tokenizing Rights vs. Tokenizing Equity

The 2018 Manhattan project hit a wall because it attempted to tokenize the equity of the owning company (the SPV). This effectively "locked" the project into a rigid Security Token framework that was difficult to manage and even harder to trade.

Blocksquare’s protocol solves this by tokenizing the Economic Rights through a Corporate Resolution. This shift provides three critical advantages for today’s market:

-

Regulatory Fluidity (Security vs. Non-Security): By tokenizing the contractual right to revenue rather than the equity shares or legal title, these tokens often fall under the EU’s MiCA (crypto-asset) framework rather than the more restrictive MiFID II (securities) laws. This allows the tokens to be transferred more freely and interact with DeFi protocols—a level of composability that 2018 security tokens could never achieve.

-

The Hybrid Payment Bridge: It is a reality of 2025 that tenants still pay rent in fiat (USD/EUR) to the property owner’s bank account. The Corporate Resolution acts as the legal "anchor" for this bridge. It creates a binding mandate for the property owner to convert that fiat into stablecoins and send it to the Distribution Smart Contract.

-

In 2018: Investors relied on manual, opaque accounting and quarterly wire transfers from an SPV.

-

In 2025: Once the property owner performs the single step of funding the contract, the smart contract handles the heavy lifting—calculating pro-rata shares, enforcing hold periods, and distributing funds with 100% transparency.

-

Default Protection for All: This isn't just for skyscrapers. Every asset on Blocksquare—from a small parking space to a commercial plaza—is protected by this resolution. It ensures that the blockchain isn't just a "list of names," but a ledger of legally enforceable claims. If a property owner fails to fund the contract, the resolution provides the direct legal evidence needed for investors to take action in a physical court.

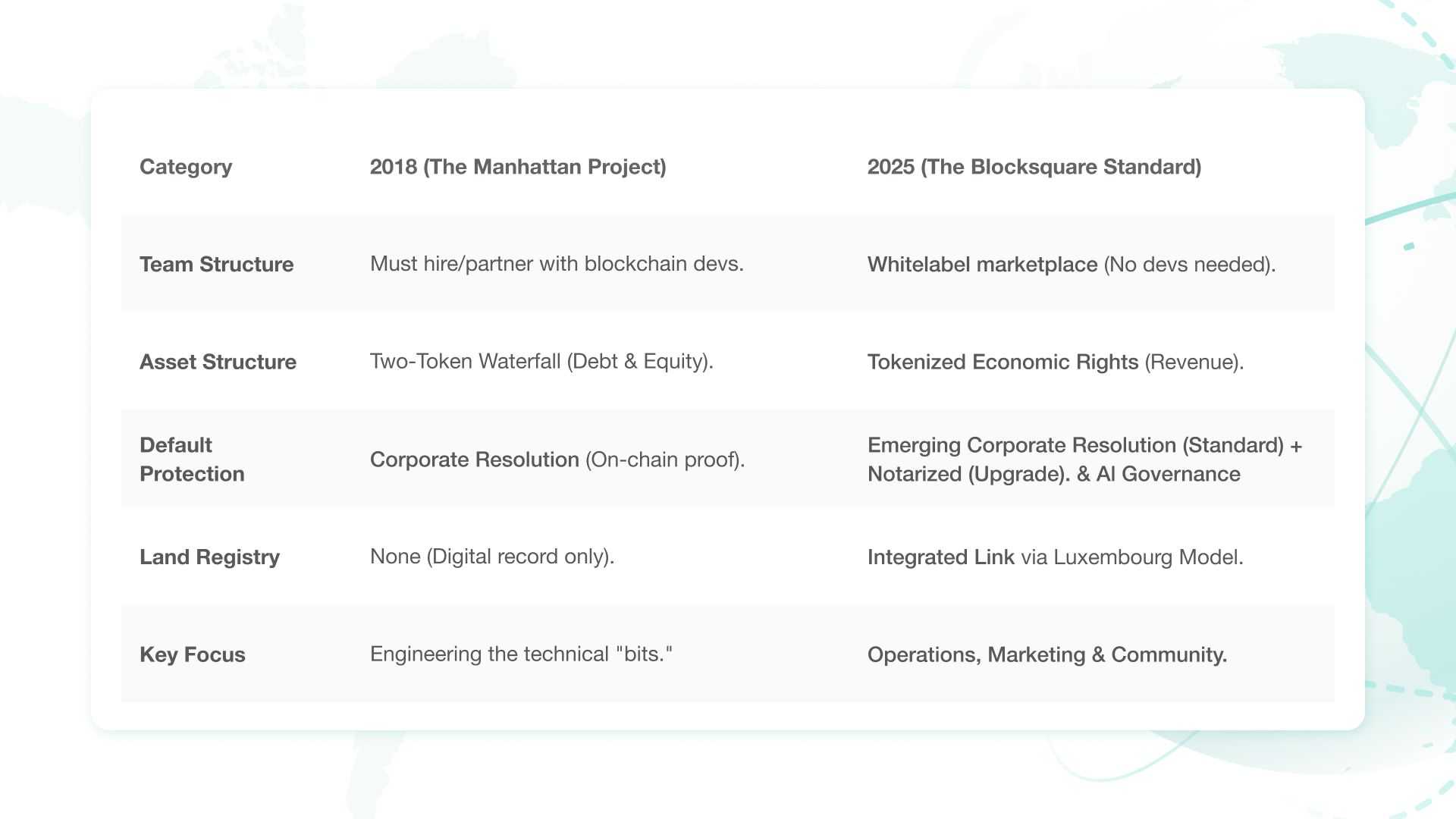

5. Comparison: 2018 Manhattan vs. 2025 Blocksquare

Conclusion: From Hype to Infrastructure

The 2018 Manhattan skyscraper video gave us the dream of buying a "piece of a building." However, the tech was too manual and the legal models were too restrictive.

In 2025, Blocksquare has bridged the gap. By using the Corporate Resolution to tokenize economic rights, real estate is no longer a static "digital share." It is now an intelligent, DeFi-compatible asset backed by enforceable legal rails. Whether through the standard resolution or the Notarized Land Registry Upgrade, the vision of 2018 has finally become a safe, affordable, and scalable reality for everyone.

Real estate teams can now stop being tech companies and start being marketplace operators. With the technical plumbing handled by the Blocksquare protocol, the focus shifts to what actually matters: operations, community, and building the future of property ownership.

The shift from 'experimental' to 'infrastructure' is here. Are you leading the charge or following the pack? Join the Blocksquare ecosystem and operate your own marketplace. Get Started with Blocksquare