The Tokenizer Launches New Report on Tokenization of Real Estate in Collaboration with Blocksquare

Real estate stands as the world's most extensive asset class, with an approximate valuation of $228 trillion. Surprisingly, a mere 3% of the global populace has engaged in real estate investment. The illiquid nature of real estate investing demands substantial initial capital, creating challenges for investors seeking swift access to their funds or the ability to adapt to evolving market dynamics.

The Tokenizer already has a long-standing record of publishing reports and whitepapers on topics within the token economy. Today, they launched their latest expert report in collaboration with Blocksquare:

Tokenization of Real Estate - and its Potential to Increase Investment Accessibility

Increase democratization and liquidity

This new Tokenization of Real Estate report proposes that tokenization and fractionalization of real estate via blockchain technology can democratize and increase liquidity in the real estate market, allowing investors of all levels to participate and benefit from the advantages of real estate investing. Tokenization involves creating digital tokens that represent ownership rights in a real estate asset, which can then be sold to investors, providing fractional ownership of the underlying asset.

The benefits of real estate tokenization and fractionalization include a lower barrier to entry and increased liquidity. Fractional ownership enables investors to buy and sell portions of real estate assets, increasing accessibility for a broader range of individuals. This report also discusses the challenges to tokenization, primarily the lack of regulatory clarity.

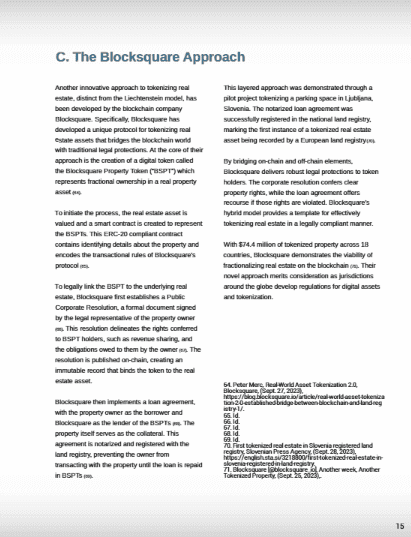

The report also highlights proposed regulatory solutions, including the Blocksquare Approach (p 15).

Access the full report here.