Unveiling the Future: The Tokenizers 2024 Who's Who Report

The 2024 edition of "The Tokenizers: Who's Who" provides a detailed overview of the asset tokenization industry, highlighting its exponential growth, emerging trends, and the key players shaping this evolving market.

As tokenization gains traction, transforming everything from real estate to fine art into digital assets on the blockchain, this report serves as a crucial guide for investors, technologists, and policymakers.

Key Highlights of the Report:

-

Industry Growth: The report notes a significant expansion in the number of companies involved in asset tokenization. Despite the removal of NFT companies from this year’s edition due to market instability in 2023, the industry has seen growth across various sectors such as issuance platforms, exchanges, and legal services.

-

Market Trends: There's a noticeable shift towards institutional adoption of tokenization. High-profile case studies include real estate and corporate debt, indicating broader acceptance and integration of tokenization into traditional financial systems. This top-down adoption is complemented by innovative bottom-up growth from new startups and tech-forward companies.

-

Regulatory Landscape: The introduction of The Token RegRadar by The Tokenizer marks a significant advancement in the regulatory landscape for the tokenization industry. Developed to address the complex and evolving legal requirements across multiple jurisdictions, this AI-based legal platform represents a pioneering effort to streamline regulatory compliance for asset tokenization globally. The tool offers a comprehensive database of curated legal information, allowing professionals to access up-to-date regulatory data and interpretive insights efficiently. Its creation underscores a shift towards utilizing AI to manage the intricacies of global regulatory frameworks, potentially reducing the time and resources required for legal research and compliance. By providing a dynamic interface that adapts to the latest regulatory changes, The Token RegRadar not only supports legal professionals but also opens up possibilities for a broader range of stakeholders in the digital asset market to navigate regulatory challenges more effectively.

-

Technological Innovations: Advancements in blockchain technology are making it easier and more secure to tokenize assets. Companies are increasingly leveraging AI and machine learning to enhance transaction efficiency and security.

-

Key Players and Innovators: The report lists and profiles major companies and platforms that are at the forefront of the tokenization market. These include pioneers in digital securities, asset management firms, and specialized legal advisors who are navigating the complex regulatory environment.

Leading Players in the Tokenization Market

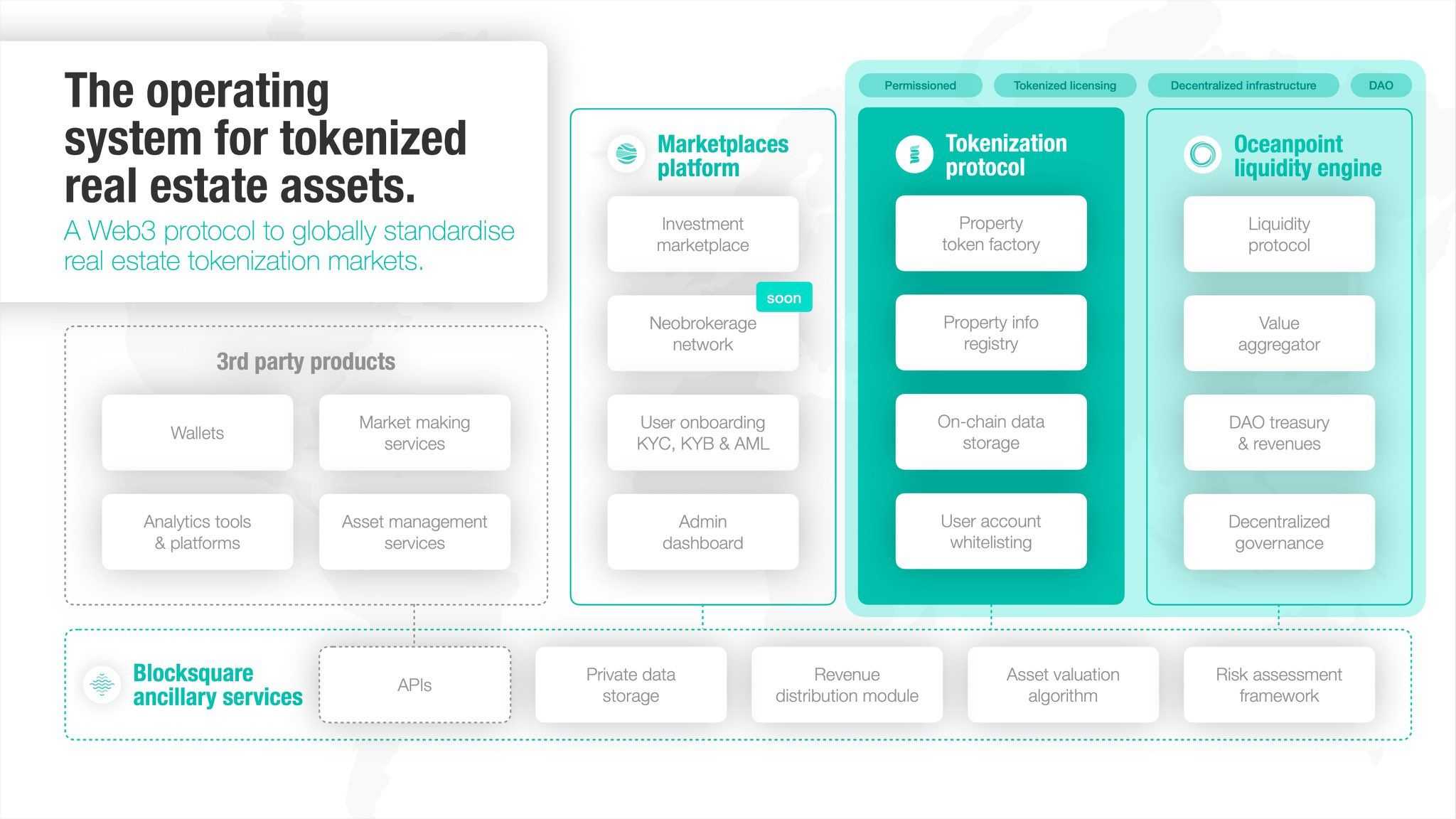

Companies like Stobox, RealT, Blocksquare and Securitize are at the forefront of the real estate tokenization trend. These platforms provide the technology and infrastructure necessary to issue and manage real estate tokens, paving the way for a more fluid real estate market.

Blocksquare's tokenization solutions enable a broader range of investors to participate in the real estate market, which traditionally has high entry barriers due to the significant capital required.

Blocksquare’s platform provides the technological framework necessary to create, manage, and trade these digital property tokens, effectively bridging traditional real estate investment with modern blockchain technology. This service not only increases liquidity in the real estate market but also enhances transparency and efficiency through blockchain's inherent properties.

By enabling the tokenization of real estate, Blocksquare contributes to the democratization of property investments, allowing smaller investors to gain exposure to a lucrative market segment. The platform plays a critical role in expanding the accessibility and appeal of real estate investment through its innovative use of blockchain technology.

The Future of Real Estate Tokenization

As regulatory environments evolve and technology advances, the scope of real estate tokenization is expected to expand. This could lead to more widespread adoption and a reshaping of the real estate investment landscape. The integration of AI and machine learning could further enhance the efficiency and security of tokenized real estate transactions, making it an even more attractive option for investors.

Real estate tokenization stands at a promising junction of technological innovation and market readiness. With its ability to enhance liquidity, ensure transparency, and open up new investment avenues, it represents a significant shift in how real estate transactions could be conducted in the future. As the market matures and overcomes its initial teething problems, tokenization is poised to become a standard practice in real estate dealings, potentially transforming the sector on a global scale.

The Future Outlook:

The Tokenizers report anticipates continued growth and innovation within the asset tokenization industry. As technology advances and regulatory clarity improves, tokenization is expected to become more mainstream, potentially transforming global asset markets by making them more accessible, efficient, and transparent.

This 2024 edition is not only a testament to the resilience and potential of the tokenization industry but also a clarion call to those involved to continue driving forward with innovation, strategic partnerships, and robust regulatory engagement. As the industry moves out of the shadows of the initial crypto craze, it stands poised to redefine the landscape of asset management and investment on a global scale.