What Do Sub-Cent Ethereum Fees Mean for the Future of Real Estate Tokenization?

Ethereum is increasingly positioning itself as core financial infrastructure. With transaction fees now near zero, the barriers to real-world adoption are rapidly disappearing.

This shift is easy to underestimate if you focus only on charts or short-term metrics. But for industries that depend on trust, settlement certainty, and long-term durability, low and predictable costs change everything. Real estate is one of them.

Why Ethereum Transaction Fees Matter for Real-World Assets

For years, tokenized real estate promised faster settlement, global access, and fractional ownership. The concept was sound. The infrastructure was not always ready.

High and volatile Ethereum transaction fees introduced friction at critical moments:

-

Token issuance

-

Rental income distribution

-

Ownership transfers

-

Secondary market trading

That friction limited how frequently real estate activity could realistically move on-chain.

Ethereum Fees Drop Below One Cent: A Structural Shift

That constraint is now fading.

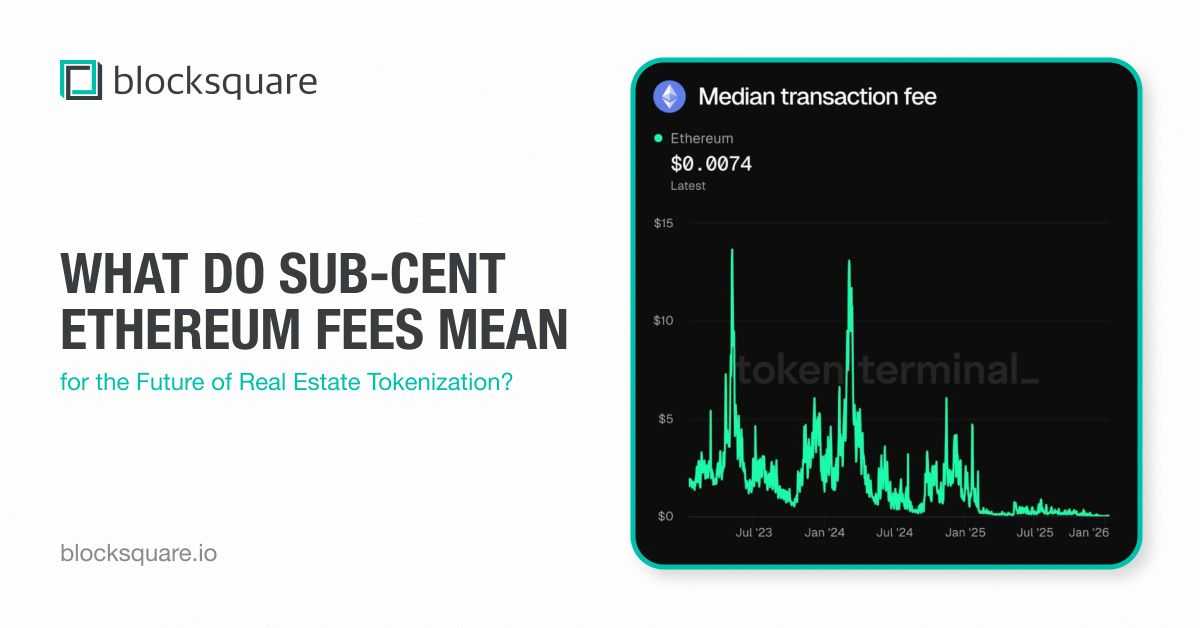

Recent data shows Ethereum’s median transaction fee falling below one cent. Not on a test network. Not on an experimental sidechain. On Ethereum itself.

This matters because Ethereum remains the most secure and widely used smart contract platform in the world. When a network with this level of decentralization becomes affordable enough for everyday use, the implications extend far beyond crypto-native applications.

For real estate tokenization, this is a structural milestone, not a temporary market condition.

Blocksquare’s Real Estate Tokenization Infrastructure Runs on Ethereum

For Blocksquare, this shift is especially significant.

Blocksquare’s real estate tokenization infrastructure and broader ecosystem operate on Ethereum, using it as the settlement layer for property-backed tokens, marketplace operations, and on-chain coordination between participants.

This includes not only asset issuance and lifecycle management, but also the staking and incentive mechanisms that support the network. Blocksquare’s staking ecosystem on Oceanpoint, along with $BST transactions, relies on Ethereum for secure execution, transparent accounting, and final settlement.

As Ethereum transaction fees continue to decline, the benefits of this architecture become more tangible.

Issuing property-backed tokens, distributing rental income, processing $BST staking rewards, and coordinating marketplace activity can now happen with minimal friction. These interactions no longer require batching, timing optimizations, or fee-driven compromises that limit participation or slow down activity.

Lower fees also improve accessibility. Participants can interact with staking, governance, and marketplace functions without transaction costs becoming a barrier, supporting healthier engagement across the ecosystem.