Why Should Property Tokens Be Part Of My Portfolio?

Property tokens are shaking up the investment world-wide by combining the reliable financial benefits of Real Estate with the innovative technology of Blockchain.

Including property tokens within a traditional investment portfolio allows a blend of real estate's proven stabilty with block chain's cutting edge technology. Digital assets democratize access to the real estate sector, redefining traditional barriers to entry and offering investors the ability to diversify, enhance liquidity, and enable transparency in their investment strategies. Let's investigate further into the compelling reasons why property tokens should be a foundation of a diversified investment approach. Or! watch the Block-chat with Makram and Daniel below.

Real Estate and Blockchain Integration

The tokenization of real estate, as systematized by our platform Oceanpoint, as of last week turned 2!

Oceanpoint, our liquidity engine is a reinvention of real estate investment modalities. It is important to consider the many beneficiaries involved, for example banks and mortgage brokers, which could be positively impacted, and processes such as document filing streamlined.

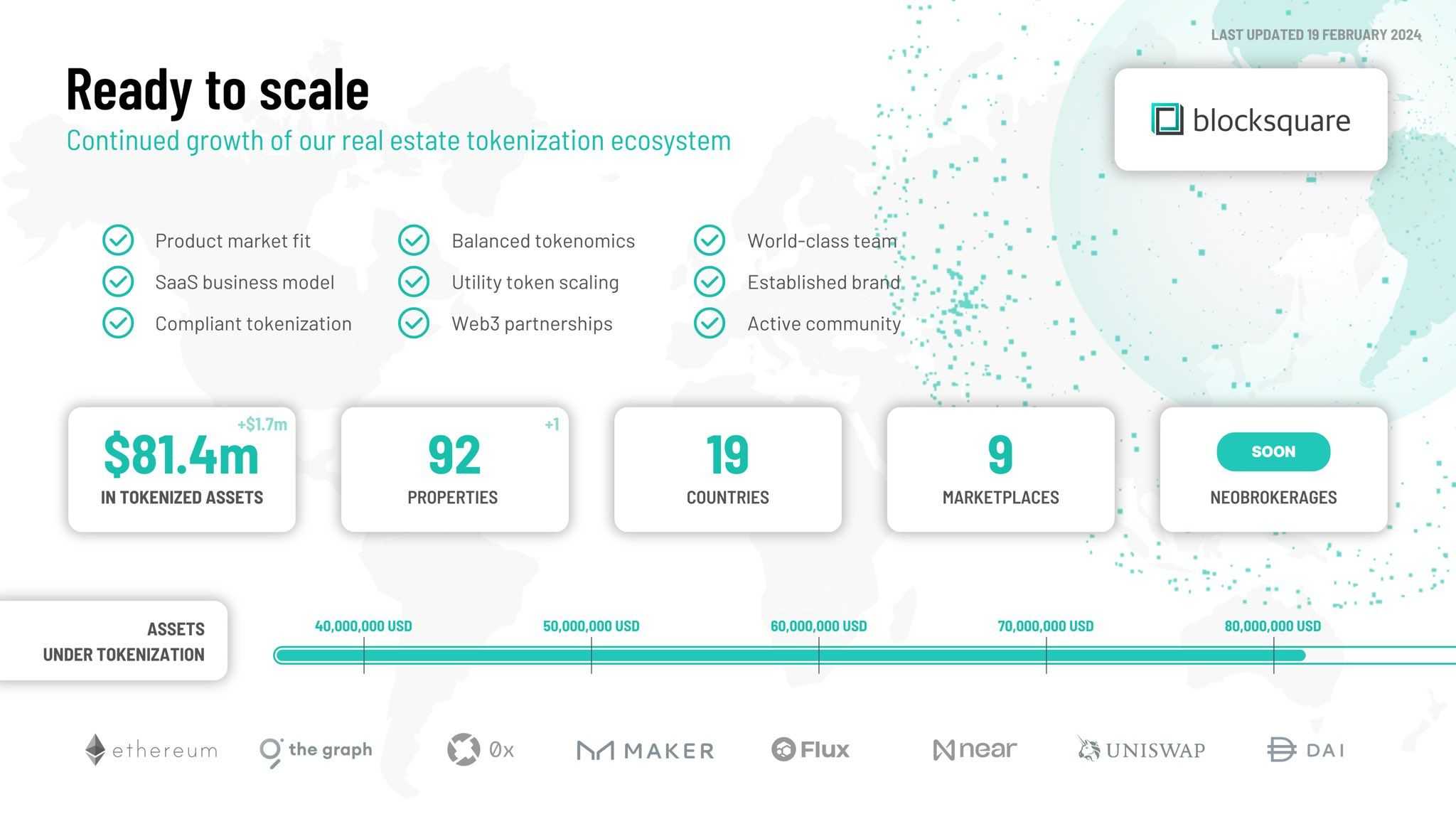

Our achievement in tokenizing 92 properties across 19 countries, with a collective worth of $82 million, is a powerful demonstration of property tokens' scalability and global appeal. This initiative merges the tangible value of real estate with the efficiency, security, and transparency offered by blockchain technology. For investors familiar with the fluctuations of cryptocurrencies, property tokens offer a stabilizing asset grounded in the real world, making them a crucial part of a balanced investment portfolio.

Unlocking Enhanced Liquidity in Real Estate Investments

Integrating blockchain technology into real estate investment addresses the longstanding issue of liquidity. By introducing property tokens, the real estate market gains fluidity, backed by the solid value of physical property assets.

This innovative blend of liquidity and tangible asset value makes property tokens an appealing investment option. It offers a solution to the traditionally illiquid nature of real estate.

Diversification Across Global Markets

Property tokens redefine the concept of diversification, enabling investors to access a broad spectrum of real estate assets worldwide, from bustling commercial hubs to serene residential locales, all through their digital wallets.

This global diversification mitigates the risks associated with specific geographic locations and the broader cryptocurrency market, showcasing blockchain's capacity to transcend traditional investment limitations.

Ensuring Unparalleled Transparency and Security

The adoption of blockchain technology enhances the transparency and security of property tokens. Every transaction and ownership change is indelibly recorded on the blockchain, offering investors an unprecedented level of trust and openness.

This feature is particularly appealing to those already familiar with the transparent, decentralized nature of blockchain investments, representing a seamless extension of these principles into the real estate domain.

Community finance

Blockchain technology eliminates the need for traditional financial intermediaries. As a result, tokenization reduces transaction costs and barriers to entry, allowing a broader base of investors to participate in the real estate market. Moreover, it enhances liquidity in the real estate sector, making it easier for investors to enter and exit positions.

By streamlining processes and opening up new avenues for investment, property tokenization empowers individuals, giving them more control over their finances and reducing the workload of large financial institutions. This change not only promises to make real estate investing more inclusive but also fosters a more equitable distribution of wealth and opportunities’

Leveraging Tokalytics for Strategic Investment Insights

Oceanpoint's upcoming Tokalytics platform represents a significant advancement in property token investment, providing deep insights into market trends, property performance, and token valuation.

This analytics tool empowers investors to make data-driven decisions, embodying the sophisticated, analytical approach that has become the norm in cryptocurrency investing.

For more information visit the Oceanpoint Documents!