Why the World Economic Forum Got Real Estate Tokenization Half-Right — And What They're Still Missing

The World Economic Forum’s May 2025 report on Asset Tokenization in Financial Markets marks an important moment. It confirms what many in the blockchain and real estate space have been building toward for years: tokenization is no longer a theory — it’s infrastructure.

What the WEF Gets Right ✅

The report correctly points out that real estate is:

-

A $379 trillion global market

-

Fragmented, opaque, and administratively heavy

-

Challenging to digitize across jurisdictions

-

Lack of interoperable infrastructure

They’re right that real estate is one of the hardest asset classes to tokenize — due to land registry systems, legal fragmentation, and lack of transferability.

But their view stops short — and that’s the problem.

What They're Still Missing ❌

The WEF focuses almost entirely on securitized models of tokenization:

-

Real estate wrapped in REITs or funds

-

Tokenization of securities rather than properties

-

Dependence on central custodians and regulated brokers

While that works for large institutions, it completely ignores the models that:

-

Work peer-to-peer

-

Empower property owners directly

-

Comply with law without being a financial product

That’s exactly what we’ve built at Blocksquare.

The Blocksquare Model: Tokenize Economic Rights, Enforceable On Title

At Blocksquare, we take a fundamentally different approach. Rather than tokenizing shares in a fund, we tokenize the economic rights to a specific property — rights like:

-

Revenue from rental income

-

Participation in equity gains

-

Exit value upon sale

These rights are issued as Blocksquare Property Tokens (BSPTs). But what truly sets this model apart is the legal infrastructure behind the tokens.

Every issuance is backed by a notarised loan agreement between the property owner and Blocksquare S.A.R.L., our token-issuing entity registered in Luxembourg. This loan is:

-

Recorded directly on the land title as a registered caveat (encumbrance)

-

Enforced through traditional property law

-

Structured to require token buyback and loan repayment before the property can be sold or refinanced

Think of it like a mortgage lien — except it’s connected to on-chain assets and a blockchain-powered investment community.

The result: token holders are legally protected, and the asset remains compliant and enforceable under real estate law — not securities law.

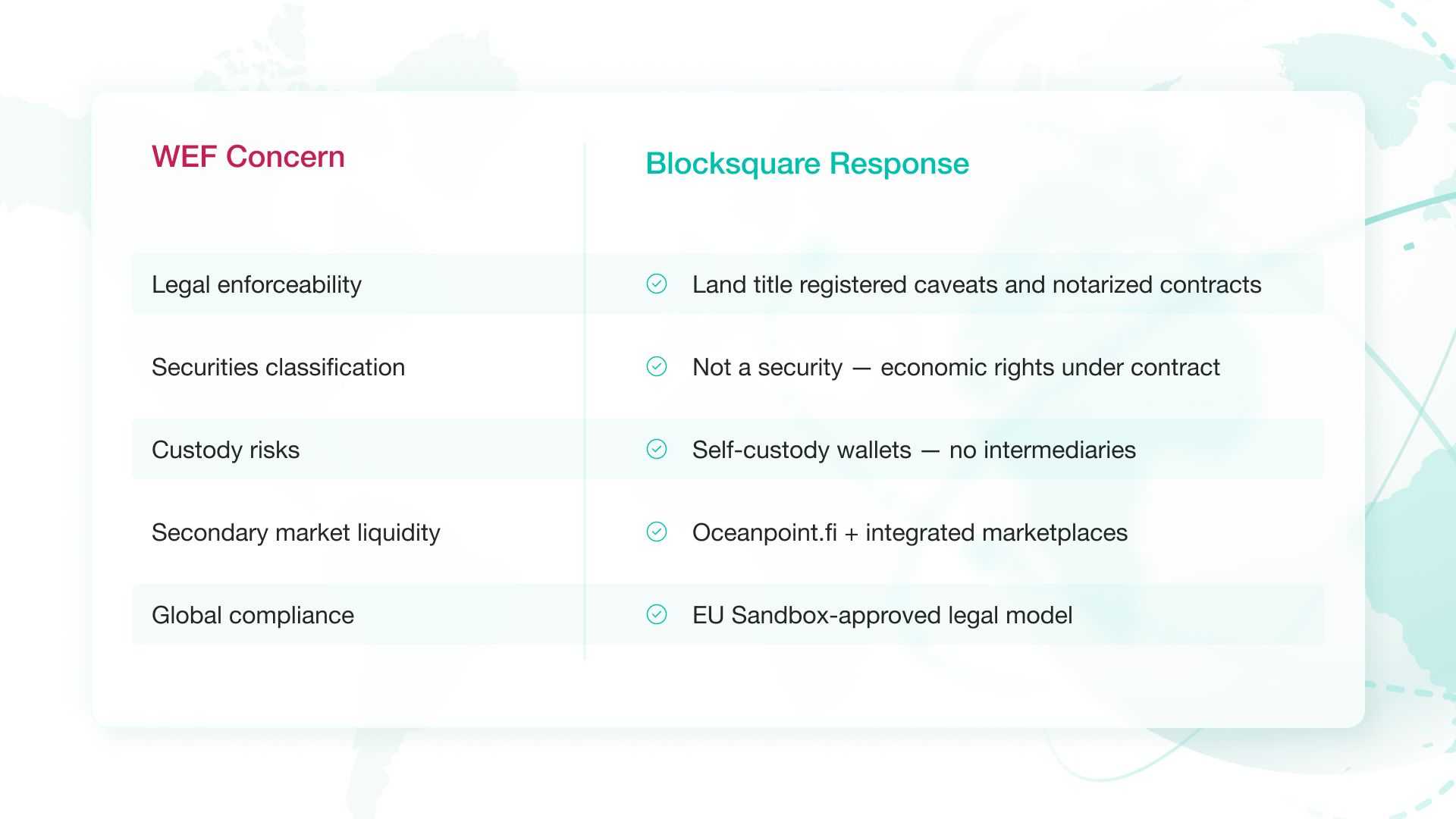

Solving the WEF’s Real Concerns

Why Tokenizing Economic Rights Is a Game-Changer

Here’s how Blocksquare's model addresses the core concerns raised in the WEF report — and why it's already operational in various countries:

1. Legal Enforceability: The token agreement is not just a digital document. It’s a notarized contract recorded against the property title in the relevant jurisdiction. That means token holders have real legal recourse—not just a smart contract.

2. Transferability Without Regulatory Friction: Because BSPTs represent economic rights rather than equity or securities, they can be freely transferred peer-to-peer, without triggering securities law in most jurisdictions.

3. No Need for Custodians: Token holders retain full control over their assets through self-custody wallets. There are no custodians, brokers, or clearing agents standing in the way.

4. Built-In Liquidity Pathways: BSPTs can be listed and traded on Oceanpoint.fi and other DeFi-enabled marketplaces, giving property owners and investors access to secondary market liquidity — something REITs and traditional fractionalization models often lack.

5. Regulatory Validation Through the EU Sandbox: Token holders are legally protected through a structure that’s fully compliant—not a workaround. Blocksquare’s tokenization framework has already been in use in Slovenia and is now also part of the EU Blockchain Regulatory Sandbox (Cohort #3). This recognition reinforces the platform’s legal robustness and its alignment with evolving EU regulations for real-world asset tokenization.

Already Operating Across Jurisdictions

Blocksquare’s infrastructure is being used by real estate operators in Europe, MENA, and US, with growing interest from emerging markets.

Depending on each property’s financial structure, operators can tokenize from 1% to 100% of the asset — unlocking liquidity without giving up ownership. The tokens are backed by real enforceable claims and tied to revenue-generating, real-world properties.

No REIT. No fund structure. No central custodian.

Just property-backed tokens, powered by blockchain and protected by law.

Why This Matters

Most “tokenized real estate” today still relies on:

-

Fund wrappers

-

Centralized platforms

-

Securities regulations

-

Custodial friction

That’s not the Web3 we believe in.

Blocksquare offers a path to legally protected token ownership, peer-to-peer trading, and programmable income — all backed by enforceable real-world contracts.

Let’s Be Clear:

-

You don’t need a REIT to tokenize real estate.

-

You don’t need a fund manager.

-

You don’t need to give up transferability just to comply.

You need a framework that aligns blockchain with land registry law — and protects both the token holder and the asset owner.

That’s what Blocksquare does.

Ready to Explore the Future?

🔗 Visit blocksquare.io to learn:

-

How our infrastructure works

-

How to launch your own tokenized real estate marketplace

-

How our legal framework has been tested and approved in the EU

-

And how to join the next wave of real estate innovation.

The WEF got real estate tokenization half-right. We’re building the other half — and it’s already live.